capital gains tax philippines

Under Republic Act No. Tax rates depend on the nature of income ie.

Capital Gains Tax Exemption Philippines With Sample Computations Youtube

Non-resident aliens are taxed on Philippine-source capital gains irrespective of their period of stay in the Philippines.

. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including. A Capital Gains Tax is imposed on the gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines. Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including.

A final tax of 6 is imposed on capital gains derived from transfers of real property located in the Philippines. 100 foreign ownership remains permissible in many areas. 9337 the RCIT is now 30 on net taxable income beginning on January 1 2009 down from 35.

The following capital gains are not subject to a holding period and are subject to special capital gains tax rates. The rates are 06 of the gross selling price for shares of. Capital positive factors tax on sale of actual property positioned within the Philippines and held as capital asses is predicated on the presumed positive factors.

The tax is based on the higher of the gross sales price and the fair market value. - A final tax of six percent 6 is hereby imposed on the gain presumed to have been realized on the sale exchange or disposition of lands andor buildings which are not actually used in the. What is Capital Gains Tax in the Philippines.

CGT is a tax that is always paid by the seller of a capital asset at a rate of six percent of its gross selling price zonal value BIR or assessed value provincialcity assessor. Whether it is compensation estates capital gains etc and are set according to a relatively straightforward tax bracket system. To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6.

The regular income tax for individuals remains at 32. If held for more than 12 months only 50 percent of the gain is subject to tax. A 6 Capital Gains Tax is imposed on the presumed gain from the sale of real property located in the Philippines which is classified as a capital asset based on the gross.

The amount that youll get from this computation will be. According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale. For example if the property is.

After you get the net estate multiply the resulting amount by 006. Estate tax in the Philippines is 6 of the net estate. The government continues to give tax incentives to investors that do business in the Philippines in these priority areas.

Doc Capital Gains Tax Is A Tax Imposed On The Gains Presumed To Have Been Realized By The Seller From The Sale Via Neslyn Palencia Academia Edu

What Are Capital Gains Taxes And How Could They Be Reformed

Capital Gains Taxes Are A Type Of Tax On The Profits Earned From The Sale Of Assets Such As Stocks Or Real Estate 7742572 Vector Art At Vecteezy

Gma News Gma News Added A New Photo

How To Get Capital Gains Tax Exemption On The Sale Of Your Principal Residence Foreclosurephilippines Com

Answered Which Of The Following Gain Is Subject Bartleby

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Ppt Download

Determine The Following Assuming He Is A Resident Citizen Taxable Income B Income Tax Due C Final Tax D Capital Gains Tax 2 Assuming He Course Hero

Elite 8 Property Solutions Inc Know More About Capital Gain Tax And Its Requirements Who Will File And Where To File Click The Link Below For More Info Https Www Bir Gov Ph Index Php Tax Information Capital Gains Tax Html Fbclid

Dept Of Finance Proposes Crypto Tax By 2024 In The Philippines Bitpinas

Understanding The Capital Gains Tax In The Philippines Bria Homes

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

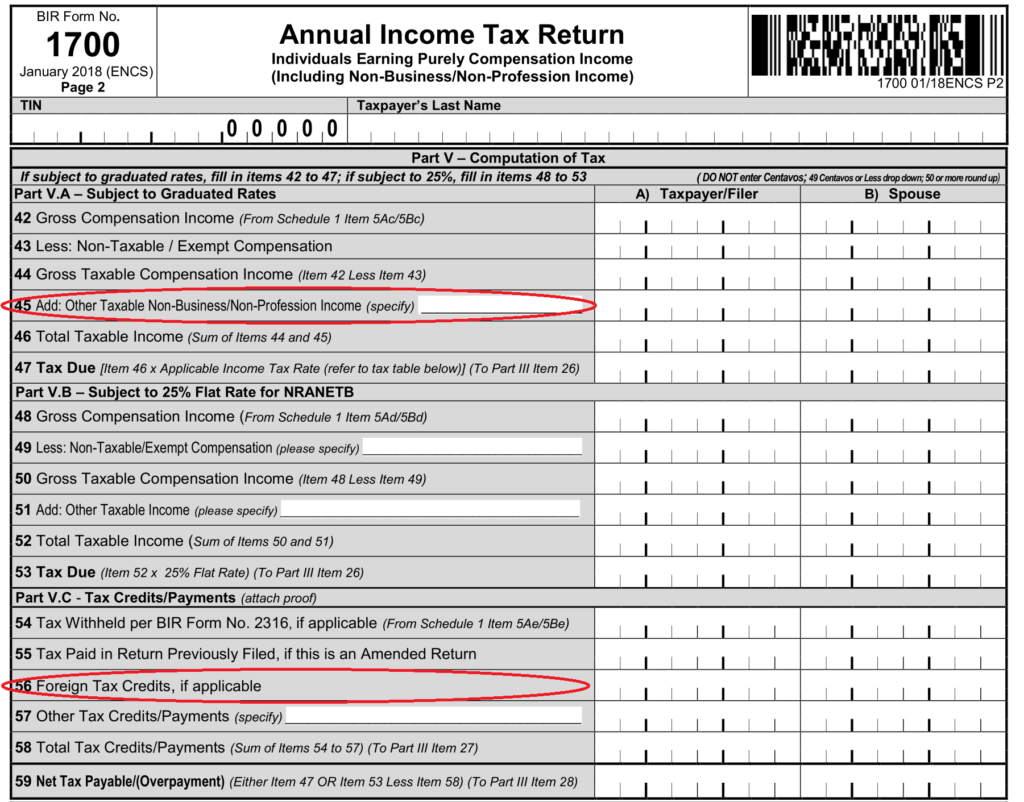

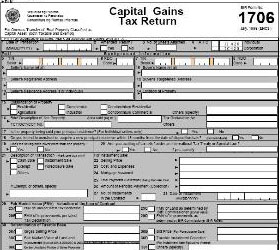

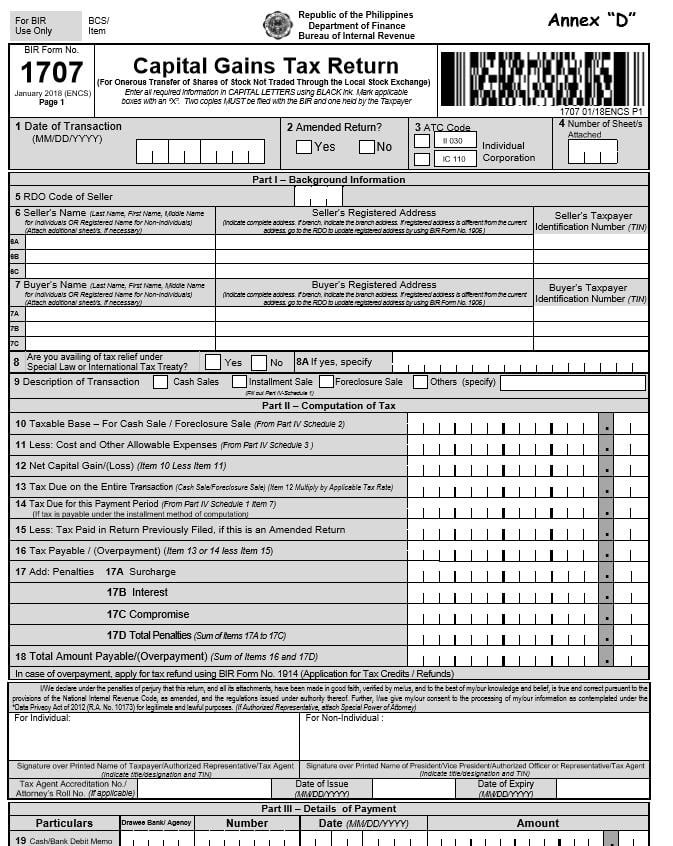

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Understanding The Capital Gains Tax Northwest Registered Agent

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It