work opportunity tax credit questionnaire required

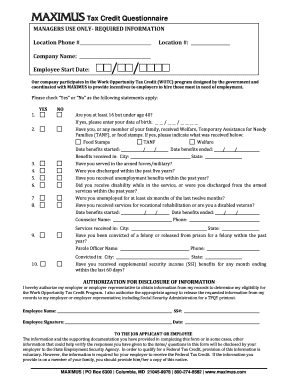

Up to 26000 per employee. Minimize the time and effort required by applicants to provide screening information with a single page questionnaire that includes the minimum number of applicant screening questions.

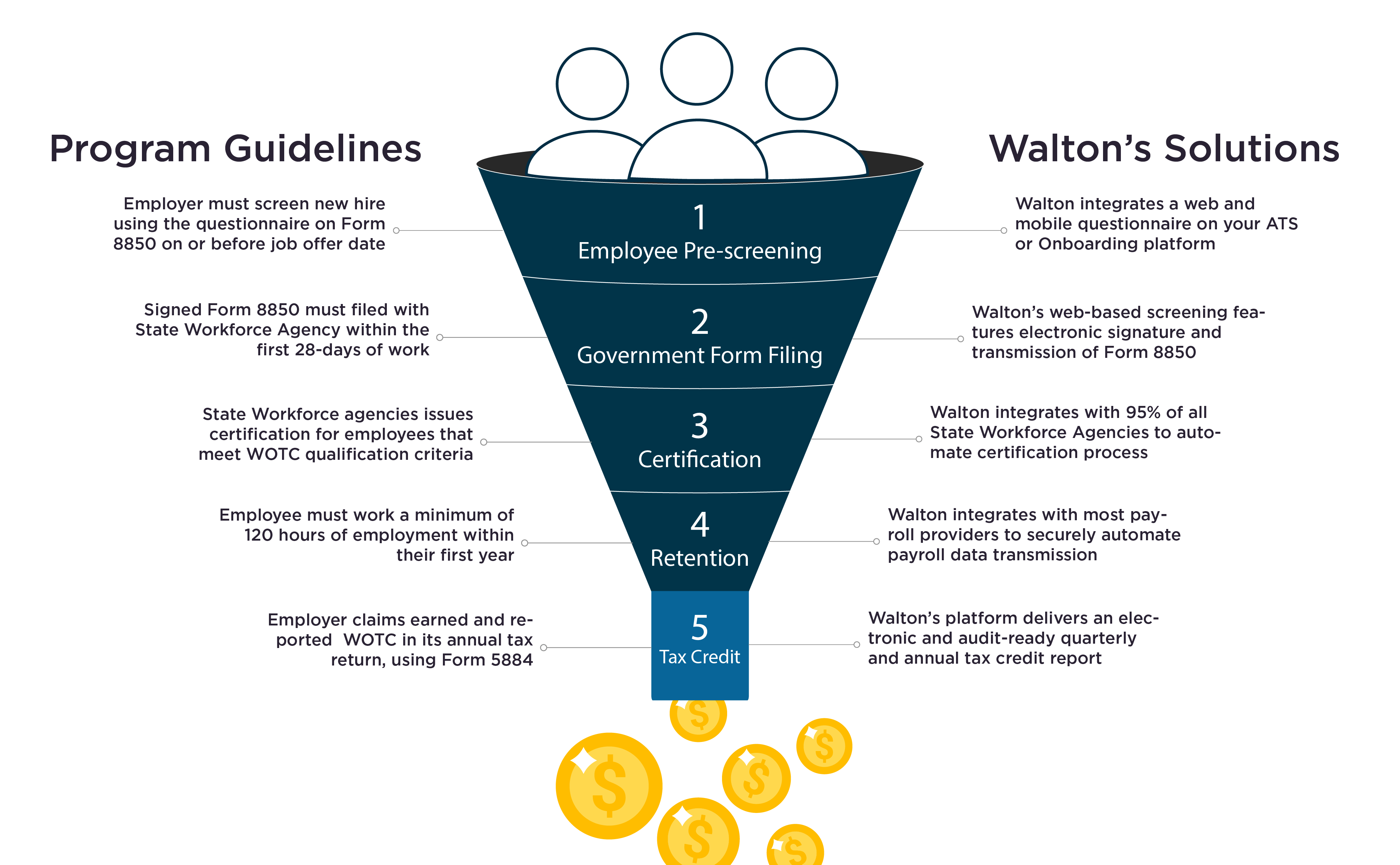

Work Opportunity Tax Credits Wotc Walton

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

. Is participating in the WOTC program offered by the government. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under penalty of perjury. Ad Even if your business received PPP loans your business may likely qualify.

If so you will need to complete the questionnaire when you apply to a position or after youve been. Californias electronic WOTC eWOTC application process is a paperless alternative to the original WOTC application process which requires employers to mail the IRS Form 8850 and. Up to 26000 per employee.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. They usually ask for anywhere from 4 to even 12 not including former supervisors. The Work Opportunity Tax Credit is calculated as 40 of first-year eligible wages up to a maximum of 6000 per employee.

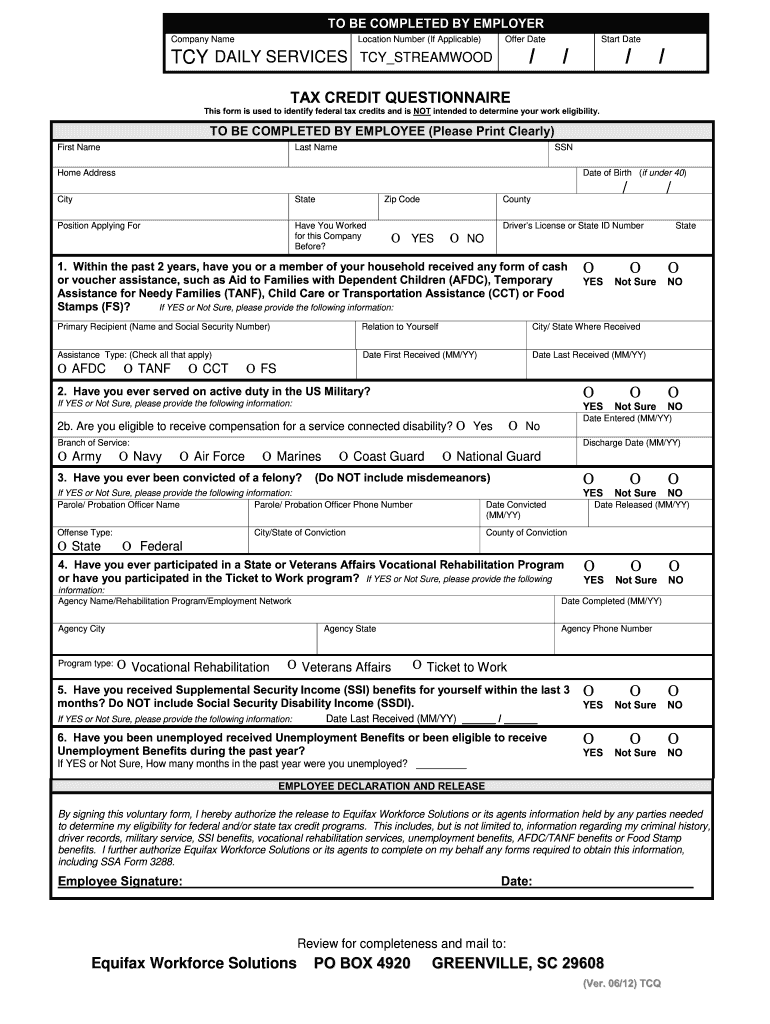

Was Your Business Affected By the Pandemic. Required Certification Forms for the Work Opportunity Tax Credit WOTC Employers are required to certify that a potential employee is a member of a targeted group in. The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you.

No limit on funding. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from. Owners Can Receive Up to 26000 Per Employee.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. You may need to download and electronically sign forms as part of this task. The forms require your identifying.

Department of Labor Office of Federal Contract Compliance Programs enforces Executive Order 11246 which requires certain. Check to see if you qualify. Submit your WOTC paperwork to the IRS and your states workforce agency for each employee within 28 days of the employees start date.

No limit on funding. The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. Talk to our skilled attorneys about the Employee Retention Credit.

Work Opportunity Tax Credit Questionnaire Page number one of Form 8850 contains the questionnaire of the Work Opportunity Tax Credit. I work in a field where references are required by each new employer. The Work Opportunity Tax Credit is a voluntary program.

EEO Voluntary Questionnaire The US. Talk to our skilled attorneys about the Employee Retention Credit. Employers use Form 8850 to pre-screen and to make a written request to their state workforce agency SWA to certify an individual as a member of a targeted group for purposes of.

Work Opportunity Tax Credit or WOTC is a business tax credit that allows companies to receive tax credits for hiring individuals that either live in certain locations or are. Ad We take the confusion out of ERC funding and specialize in working with small businesses. Ad Even if your business received PPP loans your business may likely qualify.

See If Your Business Qualifies For the Employee Retention Tax Credit. Ive noticed the reference. Updated on September 14 2021.

Keep records of eligible employees wages and. Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow.

Upload any documents needed to complete this task. The program has been designed to promote the. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

It contains questions related to. The data is only used if you are hired. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically.

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. Check to see if you qualify. If the employee completed at least 120 hours but.

It is legal and you can. Take the survey answering questions as needed.

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credit First Advantage

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Completing Your Wotc Questionnaire

With Wotc Timing Is Everything Wotc Planet

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Department Of Labor Employment

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller